I’ve made a case in my writings that, to oversimplify, the future is likely to devolve into low energy-input local societies based around widespread agrarianism in one of two main ways:

We persist with the present mostly fossil-fuelled economy until the resulting global heating, along with other drivers, brings the curtain down on our present civilization, leading to a (bad) small farm future for those (un)lucky enough to survive

We stop using fossil fuels, resulting in a lower energy civilization, perforce involving more localized and agrarian economies – a different (better) small farm future

But critics have objected that I’ve neglected a third possibility:

We stop using fossil fuels and transition to low-carbon alternatives that can support our present high-energy civilization on a like-for-like basis – hence, no curtain down on present civilization, and no small farm future

I’ve explained in previous writings why I think (3.) is unlikely, and why even a low-carbon, high-energy civilization is likely to devolve to a low-energy small farm future eventually. But I haven’t given an especially detailed account of why a transition to a low-carbon, high-energy urban-industrial civilization (what I’ve called Modern Civilization version 1.2) is unlikely. Regular readers of this site are probably aware of some pushbacks I’ve received on this front – rather lengthy pushbacks in one case – which centre on the possibility for renewable energy, particularly photovoltaic (PV) panels, to step into the breach left by the supposedly departing fossil fuels.

I don’t find these pushbacks convincing, but nor do I think their authors will be swayed from their conviction of an imminent renewables transition, certainly by anything I might say. So it’s probably best for me just to bid farewell to these renewable transition advocates and devote myself to working as best I can towards the most realistic hopeful vision of the future, namely proposition (2.). Still, I think it’s worth pausing to consider the points at issue before moving on, which is the purpose of this essay. These points are, after all, important in relation to the case I make for a small farm future.

Ideally, I’d have spent more time following this up and presenting my analysis in greater empirical detail – although this essay is already plenty long enough (sorry!). But I’m just a lone-handed writer/farmer, and even this cursory survey of the field reveals to my mind the overwhelming unlikelihood of (3.) In this essay, I’ll explain my reasoning behind this. And then that will probably be that from me for the time being on the matter of energy transition, unless I receive plausible counterarguments that seem worth engaging with.

In an earlier essay I defined my position against what I called ‘renewables proponents’ or RPs … which appealed partly because it enabled me to make an obscure mountaineering-themed joke. But on reflection I think it’s the wrong term. There’s nothing wrong with propounding for renewables. What’s problematic is propounding for a like-for-like transition of the existing fossil-based global growth economy to a future renewables-based one. A renewables-based transition to a lower-energy, more equitable, local and agrarian economy could be a wonderful thing. So it’s a case of being a sceptic towards rather than a proponent for the idea that there can be a sufficiently rapid transition from high-carbon to low-carbon sources of energy that’s able to sustain the high-energy, growth-oriented global economy in more or less its present form. I can’t quite kick the silly acronym habit, so with no disrespect intended I’m going to call people who take this position banoffees – business as nearly ordinary feasibly-fast (and) future-proofed energy-transition enthusiasts. Okay, it’s a stretch. Anyway, I believe that what these folks serve up may look sweet, but it’ll leave a sickly aftertaste.

In his fine book Navigating the Polycrisis, Mike Albert mentions “the philosophy known as ecomodernism, which can be considered the dominant approach to environmental policymaking across the world-system” (p.26). I think that’s true – truer now than it was a few years ago. Thinkers across the spectrum of mainstream politics are pivoting with increasing enthusiasm (or desperation, depending upon one’s perspective) toward putatively apolitical techno-fixes like photovoltaics (and other technologies that photovoltaics supposedly enable, like microbial food), as climate change and other threats to the present world-system they’re anxious to save ramp up.

The result for the would-be analyst of energy futures is that there’s an awful lot of breathless media commentary about the Next Big Energy Breakthrough that’ll save the world to wade through in trying to make sense of things. Much of this can be easily disregarded, but there are also more serious analyses and organisations offering some nuggets of truth among the banoffee. I’ll say more later about a couple of these organisation. As an essentially amateur energy analyst wading through a veritable tide of banoffee, it’s possible I’ve made mistakes in what follows. Of course, I’m open to correction. But just as it’s wise to be cautious of what amateurs have to say, so it’s also wise to be cautious of professional opinion, especially on matters where professional futures depend on it. Cui bono.

Though an amateur, one thing in which I have a little experience is being a micro-scale consumer of renewable energy, having lived off grid for a decade using mostly PV electricity, with a little wind-power. I’ll come back to that too.

1. Energy transition – the current state of play

The casual reader could be forgiven for thinking from the tone of much energy transition literature that fossil fuel use is crashing, and a fully renewable future is hoving into view. The reality is that 81 percent of primary energy use worldwide in 2023 came from fossil fuels. By way of comparison, the corresponding figure back in the year 2000 was 86 percent. So not a whole lot of change, though a little better proportionately. The bad news is that we used 1.5 times more fossil energy in 2023 than in 2000.

Banoffees like to emphasise that such primary energy figures can be misleading, because fossil fuels extracted as primary energy are typically less efficient at getting a job done (final energy) than electricity (secondary energy), essentially because they usually emit a lot of waste heat. So we can often achieve a given job using less electrical energy than would be the case with a fossil-fuelled approach. This is certainly true, albeit with some caveats – one of which is that much of this advantage is lost if we use fossil fuels to generate the electricity. I’ll come to some other caveats shortly. Anyway, we can get around this objection if we look only at generated electricity, while bearing in mind that currently this is quite a small part of total global energy use (getting electricity use mixed up with total energy use is a common mistake in the media).

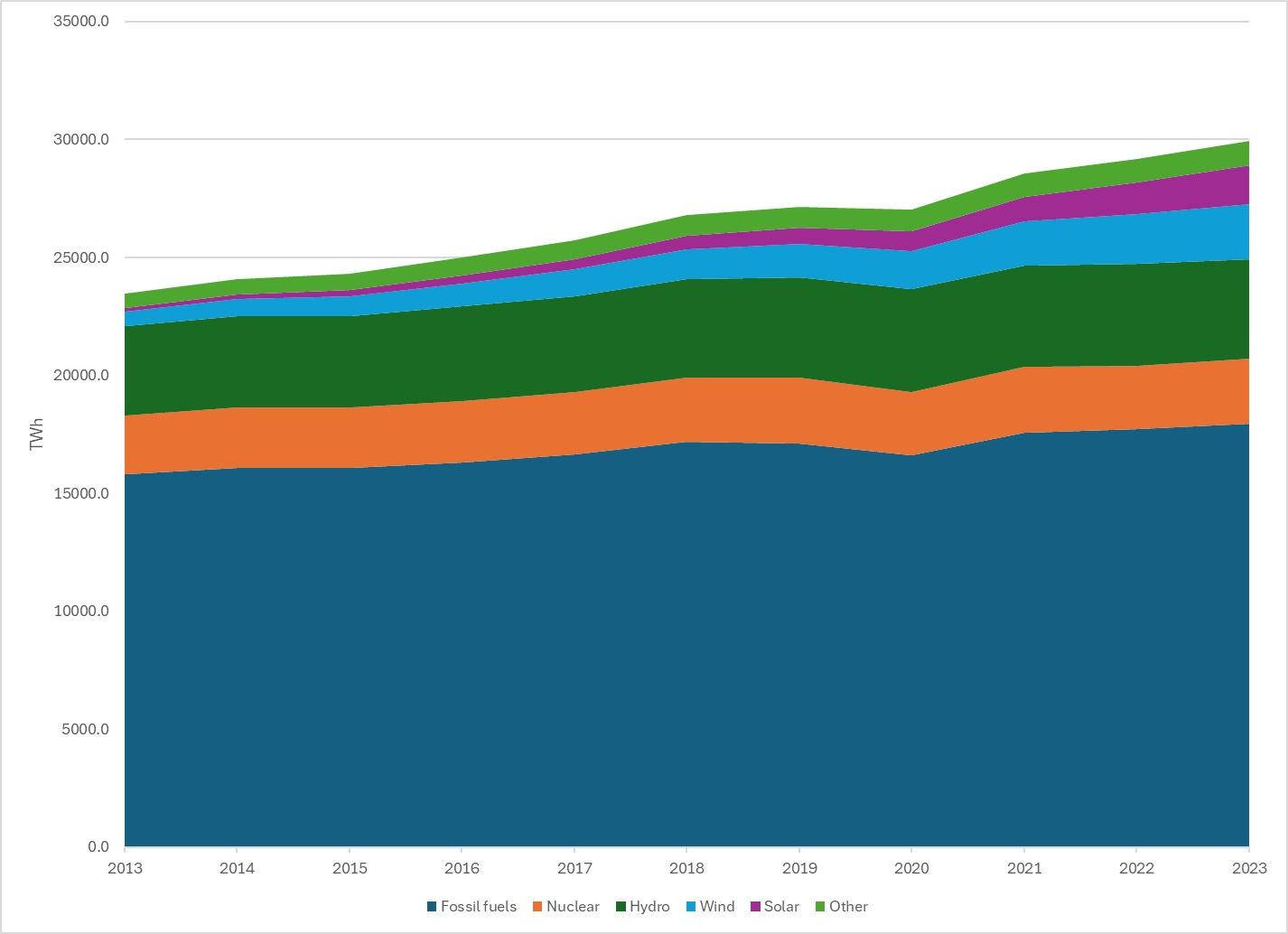

Figure 1 shows global electricity generation by energy source in terawatt-hours from 2013 to 2023.

Figure 1: Global electricity generation, 2013-23

(Note: the source of these data is the 2024 Energy Institute Statistical Review of World Energy database. This is also the source for all other data in this essay, except where otherwise stated).

The figure shows the rapid growth in renewables over that period – nearly threefold for wind, and nearly elevenfold for PV. And that, basically, is what banoffees are excited about. The problem is, the figure also shows an increase in fossil fuel generation. At 14 percent, it’s not as spectacular – but that’s only to be expected given that fossil fuels remain the dominant source of electricity generation, comprising 60 percent of electricity generation in 2023. In absolute terms, fossil fuel generation has increased more than any other single source, or about 70% of the combined increase in solar and wind. Its persisting dominance of the industry is a big problem in view of the rapid transition that’s needed, as the graph palpably demonstrates.

The main point, though, is that growth in renewables is all well and good, but in itself it’s not relevant to transitioning out of fossil fuels. Transitioning out of fossil fuels implies using less of them, and this isn’t happening.

In fact, “using less of them” greatly understates what needs to happen. We need to be using essentially none of them as soon as possible to avoid potentially catastrophic global heating – including no new coal power stations at all from now on. This isn’t the trend we’re currently on, and this failure feeds into a larger global failure even to meet current inadequate pledges to cut emissions. In the words of one analyst we “are not being ambitious enough in our objectives for cutting emissions … [and] we are not currently doing enough to make the achievement of these inadequate objectives credible. We are, in other words, utterly failing”1.

When I’ve made such points in my discussions with banoffees their response has usually just been to return attention to that thin, but undeniably growing, purple wodge of solar generation at the top of Figure 1. Can I not see how much it’s grown? Yes I can. And it’s irrelevant – you simply cannot credibly infer a transition from Figure 1, or talk only about the trends in renewables without addressing the trends in fossils. Even if there was a decrement in fossils to match the increment in renewables it would be something. But there isn’t.

The smart money among forecasters seems to be that fossil fuel use will, finally, peak in the 2030s, followed by a slow decline. That will be too little, too late. But others are still articulating the possibilities for full transition – for example, the report Net Zero By 2050: A Roadmap for the Global Energy Sector published by the International Energy Agency (IEA). The IEA used to be thought of as largely a mouthpiece for the fossil industry, but in keeping with the ecomodernist turn it’s transitioned into an ardent cheerleader for renewables, based on what strikes me (and not only me) as some pretty demanding assumptions.

Total electricity generation, the report says, has to increase nearly threefold between now and 2050. The number of coal and gas plants equipped with carbon capture utilisation and storage technology has to increase about 330-fold. On these assumptions, global renewables capacity has to more than triple to 2030 and increase ninefold to 2050, and most of this has to happen in ‘the emerging market and developing economies’. Global electricity networks “that took over 130 years to build need to more than double in total length by 2040 and increase by another 25% by 2050”. Total grid investment needs to rise to $820 billion by 2030 and $1 trillion in 20402.

Progress in the first few years of the IEA’s timeline generally hasn’t matched those projections, and the majority of what’s been achieved hasn’t occurred in the ‘emerging market and developing economies’ but in just two, albeit important, countries – China and the USA. True, China is often defined as an ‘emerging economy’, but given that it has the second largest economy in the world that seems to me somewhat misleading. ‘Emerging global power’ is closer to the mark, and more to the point in relation to energy dynamics (see Section 8).

2. S-curves

But the available data inevitably refer to the past. Another plank of the banoffee case is that the past is just so much old news. We’re on the cusp, the argument runs, of a vast impending acceleration in renewables, and a crash in fossils. The concept of the S-curve is often invoked in this instance – an initially slow increase in the replacement of an old technology with a new one (the bottom of the S, where allegedly we currently are), followed by a rapid take-off (the middle of the S), and then a slowing when the transition is nearly complete (the top of the S). The example of iPhones replacing Blackberries is often given as an analogy for how renewables will replace fossils.

The advantage of appeals to rapid future change is that nobody can prove for sure they won’t happen. We certainly need fast abandonment of fossil fuels, but there are reasons to think it won’t happen, as I’ll explain in the sections to follow. The Blackberry to iPhone example is misleading. When a cheaper, better global product comes along, yes sometimes there’s an S-curve replacement pattern. My guess is that it’s relatively rare as a proportion of all new products, and far from some law of nature in the commercial jungle. For every iPhone I suspect there are numerous Sinclair C5s.

Anyway, here we come to an important part of the renewable transition argument. Nobody doubts that renewably generated electricity is environmentally preferable to fossil energy (albeit environmentally worse than no or less energy), but banoffees take the view that since electricity is just electricity however it’s generated and renewable electricity is now generally cheaper than fossil electricity, the path for renewables replacing fossils is assured.

Neither of those propositions are true.

3. The real cost of renewables

This section draws heavily on Brett Christophers’ book The Price Is Wrong: Why Capitalism Won’t Save The Planet – a near 400-page deep dive into the economics of electricity markets. I can scarcely do it justice here, but here’s my attempt to parse Christophers’ argument:

Throughout most of the world, and increasingly so, the electricity supply chain is divided up (‘unbundled’ in the jargon) into a set of market relationships between the people who generate the electricity, the people who provide the grids to transport it to where it’s needed, the people who buy electricity wholesale to sell on to final consumers, and the final commercial or domestic consumers. If there’s to be an energy transition into renewables and out of fossils that’s driven by the low price of renewables relative to fossils, then it’s essential that this price advantage is captured by the people generating the electricity and exercising choices over how it’s generated. If not, there’s no incentive for them to switch from fossil to renewable generation. The way these markets work is such that as a rule generators don’t capture the price advantage, for reasons that are complex in detail but in broad outline will be familiar to people in the sector I mostly write about, farming. When, say, fuel or fertilizer prices fall, the farmers generating the food don’t usually get richer. The economics behind this is well established – numerous factors intercede between input costs and profits, and decreases in the former needn’t and generally don’t imply increases in the latter.

A good deal of the fanfare about the cheapness of renewables has focused on the falling price of their material components (PV panels, wind turbine mechanisms etc.) but these are just one part of the cost of bringing renewable electricity to the final consumer. Other costs are the price of land to site relatively land-hungry renewables facilities on, the price of connecting the facility to the grid and of building/maintaining grids suitable for a renewables-dominated energy world, and the price of the capital that has to be raised to fund the facility. The apparently low price of renewables manifests in a measure called the ‘levelized cost of energy’ (LCOE) – basically, the amount of electricity the facility will produce in its lifetime divided by the lifetime cost of producing it. But LCOE values often exclude the cost of grids and grid connections, which can be substantial relative to the total cost – particularly because the high land footprint of renewables pushes the facilities to low land cost areas distant from the final consumer. This often stymies the construction of new facilities in practice.

The wholesale price of electricity is extremely volatile, varying hour-to-hour, day-to-day and over longer time periods from potentially negative values when supply exceeds demand, to huge hikes when demand exceeds supply. Renewables generators have little control or certainty about their supply, meaning they have little control or certainty about the price they receive for their electricity. They often have to sell when the price is low. This is one of several reasons why even though LCOE values may be low in theory, the true cost of renewable electricity borne by generating companies is often higher, and the profits lower, than LCOE values suggest – and one of several reasons why fossil-generated electricity can remain competitive. One of my critics suggested that to address such issues all that’s needed is more generating facilities and bigger grids. Okay, but then the LCOE figure loses meaning, and the true cost of renewables is higher. This is more than a theoretical point for the people generating, buying or funding renewable electricity.

On the matter of grids, I haven’t probed the issue in depth, but I note the IEA analysis mentioned above about the need to double existing global grids by 2040 and then increase them by another 25 percent by 2050 to achieve net zero, with investment in excess of $1 trillion, which is about 1 percent of current total global economic activity. The IEA says that grid connection is currently a significant bottleneck in delivering renewable power projects, suggesting the need to add or refurbish about 80 million km of grids worldwide by 20403. Christophers reports that $6 billion was spent on adding just 5,800km of transmission lines in Texas about ten years ago, which perhaps gives a sense of the scale of the challenge. Of course, all that extra grid is going to need a lot of (currently fossil-fuelled) mineral extraction (see Section 6). This macro-scale stuff resonates with me in terms of my own micro-scale situation. It was just too expensive to connect our farm to the grid (plus it would have involved negotiation for wayleave access with an unsympathetic neighbour that was unlikely to bear fruit – transaction costs and bottlenecks is another little-analysed aspect of transition). So the better option for us was to go off-grid, generate our own electricity, limit our use of it and impose upon ourselves what amounts to a permanent if usually minor electricity supply crisis on our farm. It’s been educational.

Anyway, assuming ‘electricity is electricity’ (ie. that renewables smoothly replace existing grid electricity), to get a better sense of the real cost of renewables we need to add grid costs and factor the extra facilities needed to meet demand – and when we do this, renewable prices don’t always compare that well with fossil ones.

A key factor in utility-scale buildout of renewables is securing the considerable upfront loan capital needed for them from the finance sector. Christophers drily notes that this is the sector with the greatest power to make renewable buildout a reality, and also the one with the least interest in the purportedly low LCOE values of renewables as a way of informing their investment decisions. Banks don’t care about the low cost of renewable electricity relative to fossil electricity. They care about its profitability relative to whatever else they might invest in. Which often may not be electricity generation at all – but might sometimes be fossil facilities that for various reasons are more profitable than renewables even though they’re higher cost. If we were building an electricity system from scratch right now, things would look different – but we aren’t. In any case, debt servicing issues loom large in this sector. What’s good for renewable generators usually isn’t good for the organisations financing them, which goes some way to explaining the unimpressive rollout of renewables.

I’ll come back to these considerations in a moment. But more broadly on the ‘real cost of renewables’ front, while there’s undeniably an efficiency advantage of renewably generated electricity over fossil-generated electricity where a lot of energy in the latter case is lost as heat, there’s also undeniably an efficiency disadvantage to renewables in respect of various industrial processes. This applies essentially to processes where high heat isn’t an efficiency loss but is absolutely necessary, or where fossil fuels provide chemical feedstocks as well as energy. It encompasses such things as agrochemicals, steelmaking, plastics and cement – in other words, the material fundamentals of modern, urban, non-agrarian life.

Electricity’s share of industrial energy use remains low for this reason – typically 10-20 percent4. So there is a transition problem with these key industrial hard-to-abate sectors, which cannot decarbonise as easily or quickly as electricity generation. The IEA’s net zero in 2050 scenario projects around 10 percent less primary energy use in 2050 compared to the present. Maybe this gives a sense of how electrical efficiency vs hard-to-abate industrial sectors might balance out, although it’s based on what seem to me implausibly optimistic assumptions. We’re not, to reiterate, anywhere even close to a net zero pathway at present.

In some cases, it may be possible to tip the balance back toward renewables in these hard-to-abate industrial sectors by improving recycling and the circular economy. But this has its limits, except in steady state scenarios where new demand exactly matches scrapping/recycling. Again, this isn’t the trajectory of our present world. For example, 60 percent of steel is recycled, while recycled steel constitutes 40 percent of the total steel produced. Concrete probably poses a harder challenge, and the mid-21st century world will be facing “unprecedented burdens of concrete deterioration, renewal and removal”5. So there are some profound challenges ahead in these hard-to-abate sectors.

4. Make Government Great Again?

Many of the economic impediments to renewables adoption I mentioned in the previous section relate to the unbundled and marketized nature of the electricity supply chain. This, of course, isn’t a fact of nature any more than S-curve adoption is. In most places it’s a relatively recent outcome of global neoliberal economic policies. Would the transition be eased if governments nationalised their entire electricity sectors and created integrated, monopoly supply chains?

The short answer to that is yes. One piece of evidence is the fact that China is far and away the largest user and quickest adopter of renewables. There are other reasons behind that too, and China does have many market aspects to its electricity supply chain, but there’s no doubt that state dirigisme has helped the push.

Still, there are some complications to an ‘electrify everything, nationalise everything’ narrative.

For one thing, there are brute physical realities that assert themselves regardless of who’s running the show. Hard-to-abate sectors will remain hard to abate. The sun and the wind do their thing regardless of politics. Material and energy movements impose costs whoever is paying them. The fundamental problems of matching demand with supply remain much the same.

Second, nationalising electricity sectors is no small thing, even with unanimous support. The governmental skills, the institutional structures and the economic instruments can’t just be magicked up overnight. To go down this route would involve effecting a difficult political and bureaucratic transition as well as two difficult technical ones (electricity grid and industry). Three transitions in one – the job just got harder.

Third, far from there being unanimous support, there’s no political impetus for it in most countries – not from the architects of global neoliberalism who sit behind the throne of most governments, not from the private financial sector, and not much from the general public either. Although I dislike easy contrasts between ‘progressive’ and ‘populist’ politics, I’ve done enough podcasts with climate change sceptics who sense the hand of big government behind every utterance of the phrase ‘net zero’ to suspect that this just won’t play politically in many countries. Even the little-bit-leftish-if-that’s-okay-with-you kind of governments that manage to get elected such as we now have in the UK are nowhere near on board with this, and are seemingly more intent on taxing the often non-existent profits of the private electricity sector.

Don’t get me wrong – I wouldn’t mind seeing a bit more nationalisation. And/or a bit more market discipline in this area for libertarian-minded folks – you can have resilient grid power on tap or you can have a private electricity sector, but not both. Still, that’s not where politics are generally at in the Global North. The same is basically true in much of the Global South, as governments pursue market neoliberalism to promote the ‘emergence’ of their economies. Let’s be clear about this: as well as a lot of actual rewiring, serious governmental forcing of a renewables transition would involve a complete political rewiring of the global economy in ways that are simply not on the table at the moment.

In practice, what governments have done instead is a lot of fiddling with market incentives and subsidies. Most of the growth in renewables shown in Figure 1 is attributable to such fiddling (of course, they also fiddle with the fossil energy sector). But it clearly hasn’t been nearly successful enough. One way in which it often hasn’t been successful is in creating renewables ‘gold rushes’ that create oversupply, government retreat and starved new investment – short booms, and long busts6. So, just when it seems like the S-curve is really taking off, it starts reversing. More of an omega-curve.

In summary, and going back to my opening propositions, critics of mine have suggested that I can offer no plausible politics to show how my proposition (2.) is going to manifest. They’ve got a point (though see Section 10). But there don’t seem to be any plausible politics to show how proposition (3.) is going to manifest either.

For all the talk of romantic fantasies levelled at agrarian localists like me for supposedly wanting to turn the clock back to a simpler time, there’s a kind of Keynesian happy place entertained by such critics which itself involves social-democratic fantasies of turning the clock back to the simpler politics of the early 1970s, when governments had control of energy systems and national finances, before the rot of neoliberal globalization set in. For sure, neoliberal globalization needs to end – but that’s not going to bring the Keynesian happy place back. There’s too much debt, and too little real growth.

5. Batteries to the rescue?

A big technical advantage that fossil fuels have over renewables is that you can pretty much turn them on and off as you please. They come, as it were, with their own switch and battery. Whereas to replicate that advantage with renewables you need to add in actual batteries as extras.

My domestic renewable system comes with batteries to see us through for a while when the sun and wind desert us – massive, clunking lead-acid things that cost about half the entire setup. There’s an almost endless trumpeting of better, new, grid-scale forms of electrical energy storage in the literature promising to send batteries like mine the way of the Blackberry.

Good news, no doubt. But making it work at grid scale over the next couple of decades from a more or less standing start represents a fourth massively challenging transition that we’re potentially facing. Of course, the efficiency loss of energy conversion and the cost of the batteries themselves would have to be added to the renewables costs. Along with the costs of prematurely junking and safely decommissioning older storage technologies.

I’m afraid my head is too dizzied by all these proliferating urgent transitions implied by a renewables transition to try to get into those costs here. But I’d be interested to see analyses that consider them. Not analyses that enthuse about the abundance of sodium in the Earth’s crust to ‘prove’ that the transition to sodium batteries is easy, but analyses that fully cost out a global transition to constant and adequate renewable grid power, including their full life-cycle costs as appropriate.

6. Minerals

It’s widely accepted that a transition to renewables will involve a huge increase in the mining of the numerous minerals needed to build the relevant infrastructures, with concerns about reserves, quality of ores and costs. Opinions vary as to how feasible this will prove to be. I only touched on the issue briefly in my book Saying NO to a Farm-Free Future, citing among others Simon Michaux’s doubts on this score, which occasioned some pushback from critics who dispute his analysis.

I have no expertise on this issue, but let me cite another couple of views. One is from a paper that advocates bullishly for the possibility of a 100 percent renewables transition. The paper states:

All in all, there appears to be reason for moderate optimism that material criticalities will not represent an unsurmountable roadblock towards the transition to 100% RE systems. However, it is also clear that it will be a formidable challenge to ensure the timely availability of resources while simultaneously minimizing the negative impacts of extraction on humans and the environment. This needs to be a focus of upcoming research7

Reason for moderate optimism against unsurmountable roadblocks along with formidable challenges doesn’t suggest an altogether smooth path, especially in a state of the art banoffee opinion-piece. And surely the challenge of accessing adequate resources while minimizing negative impacts needs to be more a focus of immediate resolution than of upcoming research?

Another view comes from Mike Albert, based on IEA and other studies:

In the context of rapidly rising RE demand, there would most likely be no easy or quick solution for mineral bottlenecks, and this could plausibly, in conjunction with other obstacles, derail the transition or at least slow it down considerably8

One of those other obstacles could be the declining availability and energy returns from the fossil fuels needed to fund the transition energetically, as suggested by the IEA among others, preventing a renewables transition that can’t bootstrap itself.

So, who knows? But as things stand it seems to me that the scepticism I expressed about the mineral basis of a renewables transition in Saying NO… remains justified.

Another aspect of mineral mining is the ‘green sacrifice zones’ of poisoned places and potentially poisoned people caused by mineral mining. Banoffees often point to the ‘black sacrifice zones’ of fossil fuel extraction by way of exculpation. Certainly, if you set the bar as low as ‘not as bad as fossil fuels’ then a lot of things can jump over it.

7. Energy cliffs, energy traps and economic slips

Let’s now turn to energy return on energy invested or energy return on investment (EROEI or EROI). This refers to the fact that to obtain useful energy you first have to expend some energy – constructing a coal mine, building a PV panel or whatever. If the EROI ratio is one or less, you’re spending as much or more energy than you’re getting back, which defeats the object. Typically, EROIs for renewables are lower than those for fossil fuels, but fossil EROIs are declining.

I’ve seen some renewables proponents dismiss EROI as an irrelevant concept, a position I find unfathomable. But the fact that renewable EROIs are typically lower than fossil ones doesn’t in itself rule out a transition from the latter to the former. The real problem is transitioning from a higher to a lower EROI source in a competitive global economy geared to economic growth, especially where the costs of the lower source fall mainly upfront, as is the case with renewables.

I’ll briefly lay that out via the concepts of energy cliffs and energy traps. Energy cliff refers to the idea that declining net energy (net energy is similar to EROI: total energy extracted minus the energy needed for extraction) is non-linear – as the EROI of an energy source decreases the net availability of energy to do useful work in the economy decreases relatively more. This is a problem in a competitive economy built around the need for continually expanding the work that’s done, and where expansion is coupled to energy use. It’s particularly a problem when the energy investment required of the new energy source is loaded upfront. This creates a big economic incentive to delay switching, creating in turn a negative feedback where the possibility for switching in the future becomes progressively bleaker. This is what’s known as the energy trap, explained further here. Perhaps the resolutely non-transitioning electricity sector shown in Figure 1 stems in part from such a trap. Anyway, a plausible case for a renewables transition has to involve an analysis of the economics of the transition that shows how it will surmount the chill economic winds of declining fossil EROIs and energy traps.

If the global economy wasn’t built around competitive growth, then a renewables transition would look more feasible. So maybe the price – or benefit – of transition would be the end of global capitalism and the degrowth of the global economy. Going back to my three opening propositions, that means proposition (3.) is untenable. A renewables transition would involve smaller, inevitably more local, steady state economies. More like the small farm future of proposition (2.) But that takes us back to the charge of implausible politics I mentioned in Section 4 that some of my critics level at me. It looks like the same charge might rebound on them.

Anyway, let’s say a bit more about politics.

8. Geopolitics

Unfortunately, the renewables transition toward smaller and more local economies that I and (implicitly) some of my critics seek doesn’t seem likely given the political shape of the present world. I’ll try to illustrate that in this section with a few points about wider global geopolitics, and a point about national politics.

Our present fossil-fuelled geopolitics is a story written mostly by the USA in the aftermath of World War II. The US was the only global military superpower, facing off with the Soviet bloc and building a trade-based global pax Americana reliant on its military sea power and fossil energy mostly from its own and from Gulf reserves.

The Soviet bloc has now gone, although Russia has morphed into a different threat. The US remains for now the only global military superpower, but the trade-based pax Americana is waning. A more multilateral scene is emerging, particularly around China, and also India and a few other regional power centres. The global balance of power is becoming increasingly volatile.

In this context, energy security looms larger and renewables have a significant role in it. Few countries are self-sufficient in fossil fuels, and this makes them vulnerable to outside political designs. Renewables are a safer bet – nobody can cut off a country’s sun and wind. A large part of the impetus toward renewables in countries like China and India has been about building their energy security.

On the face of it, this may look like good news from a climate change point of view. So long as a country is building its renewable capacity, does it matter whether the motivation is ethical commitment to decarbonisation or more self-serving concerns about energy security?

Unfortunately, the answer to that is probably yes. Decarbonization, remember, means replacing fossil fuels with low-carbon energy. And this isn’t really happening in the main strategic countries whose decisions in the coming years will make or break the climate. What these countries mainly seem to be doing is diversifying their energy mix for security reasons with more renewables, which isn’t the same thing at all. Instead, the pursuit of economic growth, energy security and geostrategic power is likely to drive increases – or at least retrenchment – in all forms of energy, including fossils. And this is pretty much what seems to be happening.

It’s possible that decarbonisation may even reverse in the future as countries seek energy security and strategic advantage. Coal is more widely distributed than the less carbon-intensive oil and gas, and it’s possible that economic and strategic drivers will push countries to ramp up the use of local coal resources. Militaries in general and military conflict in particular are notoriously high greenhouse gas emitters (at least 5.5 percent of worldwide emissions can be attributed to militaries9) and – notwithstanding that ‘climate-friendly warfare’ sticks in the throat – represent another hard to abate sector. Despite the fact that US global power is declining (or maybe because of it), it seems unlikely that the USA will give up its fossil-fuelled control of its oceanic trade empire without a fight – in Amitav Ghosh’s words “the world’s most “advanced” countries [have] a strategic interest in perpetuating the global fossil-fuel regime”10.

On the home front, governments are anxious to maintain constant grid power as part of the implicit compact that keeps them in favour with their citizenries, and therefore ultimately in government. As discussed earlier, constant power can be achieved with renewables, at a cost that’s neglected in standard presentations of their cheapness. But it’s a risky punt, and in practice most governments prefer to use fossil generation as first-choice backup to meet peak demand.

Such efforts to maintain the grid don’t always work. Here’s the opening of a chapter called ‘Electric Nightmares’ from Brett Christophers’ book, which indeed seems like a nightmare portent of the future:

In the summer of 2022, much of the Indian subcontinent was roiled by a deepening electricity crisis. The crux of the crisis was insufficient power generation. In parts of Bangladesh, where the government battled to dampen demand through measures such as controls on the use of air conditioning, rolling power blackouts of five, nine or even twelve hours a day were reported …

The proximate causes of the crisis were easy to identify … India, for instance, recorded its warmest weather in over a century, causing peak electricity demand – driven by tens of millions of air conditioning units …. Partly the problem was a simple shortfall of generating capacity, and, in particular, of capacity located close to where demand was concentrated … But more than that, the problem was fuel shortages. All three countries still rely predominantly on fossil fuels to produce power … and all three were faced with acute fuel deficits ….

In Bangladesh … the authorities hurried to ready new coal-fired power plants10

This raises several noteworthy points. One of them is the dread prospect of positive feedback loops in relation to climate heating: heating → increased air conditioning use → increased electricity demand → increased fossil power generation → increased climate heating. Another is the likelihood that electricity generation and grids won’t be able to cope with existing demands let alone with the new and higher demands imposed by renewable transitions and climate change (not to mention manufactured food…) A third is potential political breakdown.

Another part of this story is that a similar crisis, with different causes, blew up in Europe at around the same time as the South Asia crisis, which European governments mitigated by buying gas on global markets – driving up prices to levels they could afford, but poorer countries such as those in South Asia couldn’t. So, constant grid supply at a price for the rich, power blackouts for the poor, and everybody scrambling to source fossil energy. This could well be a portent for deepening global supply chain crises likely to stymie any potential rollout of renewables.

Currently, many large, populous and relatively poor countries rely largely on fossils, particularly coal, for their electricity. Indonesia, for example, is the world’s fourth most populous country and eleventh largest energy user: 81 percent of its electricity comes from fossils and 11 percent from renewables. In Africa as a whole, 74 percent of electricity comes from fossils and 6 percent from renewables. Generally, these are places that need more energy. For a worldwide renewables transition to happen, something very, very different needs to happen than occurred in the 2022 electricity crisis. Essentially, it would be a massive transfer of technology and local generating capacity from the richer to the poorer countries – a fifth challenging transition to add to our list.

Ultimately this transition wouldn’t be about technology, but justice. Amitav Ghosh:

It is largely in affluent countries … and mainly among the more privileged, that climate change is perceived as a techno-economic concern oriented toward the future; for the have-nots of the world, in rich and poor countries alike, it is primarily a matter of justice, rooted in histories of race, class and geopolitics11

In this way, the renewables transition depends upon yet another transition, a justice transition – another transition that’s not currently happening.

9. On-grid

One criticism that comes the way of we localist transition sceptics is that, wittingly or otherwise, we’re giving Big Oil a helping hand with our scorn for renewables. I’d argue on the contrary that fossil interests – and Big Capital generally – has a much poorer fit with our arguments for quitting fossil fuels and localising the economy than with the banoffee transition narrative.

For sure, fossil energy companies have engaged in outrageous foot-dragging and misinformation about climate change in pursuit of their agenda, but ultimately that agenda is to make money, not to sell hydrocarbons for fun. Some oil companies have tried to pivot to renewables, but then beat a hasty retreat when the profit and loss account came in. As large and wealthy transnational corporations, they’re well placed to pivot back again if those accounts start to tell a different story. The lack of interest in renewables from the fossil industry says something about their true cost.

So again, profitability is the bottom line. Christophers mentions that the focus of BP’s ‘climate friendly’ portfolio is not in renewables generation but in more profitable activities such as low-carbon gases and electric vehicle charging networks. This seems to be borne out in my neck of the woods.

As is generally the way in modern capitalism, the spoils fall not to the content creators but to the big beasts who can monopolise circulation.

It’s interesting to see this playing out. The Rocky Mountain Institute is the brainchild of Amory Lovins, a hipster renewables guy in the sense that he’s been advocating for them since long before they were cool. In the 1970s, he came up with the idea of soft energy paths, which has affinities with localism – mixed, low-impact energy technologies scaled to people’s social ends, with an emphasis on micro grids and decentralized networks. According to Influence Watch, the RMI had an annual revenue of $9.9 million in 2010, while total annual revenue had risen to $115.1 million by 2022.

The rise in revenue seems to have gone hand in hand with declining commitment to soft energy paths, and the RMI has pivoted towards advocacy and policy analysis geared to full, on-grid, hard energy path renewable transition compatible with existing patterns of power and geopolitics. This recalls Amitav Ghosh’s point about climate change as a “techno-economic concern oriented toward the future” for the privileged. There’s a sense here of the more strategic-thinking sections of the capitalist business class pivoting to renewables, in good faith no doubt, kind of as the last chance to save, well, the business class and the capitalist status quo, with outfits like the RMI as their vehicle.

Talking of pivoting as I have been, it brings to mind a nice story from Dougald Hine’s fine book At Work In The Ruins. Dougald says he was contacted by a former policy analyst who’d then gone into the startup world with a healthcare focus and was now “looking to pivot to climate change (with a hybrid policy and entrepreneurial bent”.

Dougald writes:

I saw two things at once. First, I had nothing to say to this guy …. second, I saw that climate change now belonged to guys like him: that once they ‘pivoted’ in to save the day, theirs would be the terms in which we all had to talk if we wanted to sound serious. (p.22)

10. Off-grid

Sounding serious is the strong suit of techno-fix narratives. But for the reasons I’ve outlined above, whether they actually are serious solutions to the present meta-crisis is more questionable.

One of the ways they sound serious is in their pro-poor, economic development vibe. As I suggested in Saying NO… this has long been a tactic of technical progress arguments, used with greater or lesser degrees of cynicism – our new trick is better for the poor, and anyone who says otherwise is a naïve romantic or a cruel fantasist. The new trick rarely does turn out better for the poor, but it does often succeed in breaking up old lifeways and solidarities, and better assimilating poor people, indigenous people and people who have otherwise managed to wrest some autonomy from the ever-advancing logic of capital creation back into the next cycle of that process.

Brett Christophers touches on this in relation to the pastoralists of northern Scandinavia, where:

The development of wind farms has increasingly interfered with Sámi reindeer-herding grounds, threatening at once community livelihoods, ancestral traditions and wildlife itself. What, people are led to ask, takes precedence? The global climate fight? A (post)colonial nation’s quest for energy security? Or the repeatedly violated rights of a minority people? And who ultimately decides?12

I wrote along similar lines in relation to indigenous hunting, pastoralism and farming in Saying NO… in the context of the push for manufactured microbial food, a technology that’s completely reliant on a switch to renewable energy at probably an order of magnitude greater than our present energy economy (p.121).

Who, indeed, gets to decide? Ecomodernist, techno-fix narratives brush such questions aside, invoking technology as a substitute for politics. Once we’re all gridded up – heat pumps instead of woodburners, microbial food instead of meat or beans, nature reserves and carbon offsets instead of farms and so on – we can still be ‘political’, but we’ll have no autonomy of livelihood action from which to articulate a politics. Seriously, let’s stop talking about sodium batteries, seaweed, insects or a trillion trees and start talking about local politics instead.

So I’m planning to head off-grid in a deeper sense than the mere technicalities of my own electricity supply. I don’t think renewables transitions are a serious likelihood for most people worldwide, but I don’t expect to be taken seriously by those who think otherwise. As I said in a recent post, I’m (almost) done trying to have serious discussions with them, because they so rarely bear fruit.

I’m planning instead to adopt the (serious) roles of the jester and the mystic in future writing, using them to plot a course as best I can to my opening proposition (2.) to help steer away from our present collision course with proposition (1.)

I don’t see this particularly as a counsel of despair. The story of (1.) and (2.) hasn’t been written yet, and the more we can get off-grid, use soft-energy paths and agroecology, and build local communities, the more we can avoid getting wrecked by the siren song of the banoffees. The main impediment is the lingering commitment of our politics to proposition (3.) which will further snare us in the energy trap and make the positive possibilities of proposition (2.) that much harder to achieve. As I see it, the blandishments of the banoffee transition and proposition (3.) is the real counsel of despair. Ultimately, we’re in the grip of systemic meta-crisis, not bad choices over energy supply.

For sure, there isn’t a ‘serious’ mainstream politics of agrarian transition in most places currently, in large part because there’s a lot of work among ‘serious’ political actors and commentators to ensure that remains so. But if you look to what a lot of ordinary people are doing and thinking around localism and land use, you get a different picture. The times are a-changing and I haven’t given up hope that versions of proposition 2. may get established in some places. As ever, renewal comes from the margins, not from the centre.

The neighbour who I failed to ask for an electricity wayleave has moved on. But I’m used to living off grid now and don’t really want to change. Friendlier folk have moved in, and started a small market garden. That’s a whole other story. But what I mean to say is that off-grid doesn’t have to mean isolation or survivalism. There’s a world of localism to be won.

Notes

Brett Christophers. 2024. The Price Is Right. p.342

IEA. 2021. Net Zero By 2050: A Roadmap for the Global Energy Sector. Pp.117-18.

https://www.iea.org/reports/electricity-grids-and-secure-energy-transitions/executive-summary

Vaclav Smil. 2022. How the World Really Works. p.99.

Christophers, p.205

Christian Breyer et al. 2022. On the History and Future of 100% Renewable Energy Systems Research. IEEE Access doi 10.1109/ACCESS.2022.3193402 pp.78191-2

Michael Albert. 2024. Navigating the Polycrisis. p.45

Albert, p.185.

Amitav Ghosh. 2022. The Nutmeg’s Curse. p.110.

Christophers, pp.305-6.

Ghosh, p.158.

Christophers, p.87

Thanks for those comments Elisabeth & Bob. I took the liberty of pasting them into the comments section of my home website, and replying to them briefly there: https://chrissmaje.com/2024/08/off-grid-further-thoughts-on-the-failing-renewables-transition/#comment-263971

One thing that people who compare fossil fuels mined to other metals and minerals mined for so-called renewables (actually rebuildables) do to obfuscate the devastating impacts of moving from a fossil fuel-intensive energy system to a materials-intensive energy system is to compare the end product of metals and minerals and not the total amount of ore moved or the areas devastated by tailings.

While steel can indeed be recycled, for a full build out of rebuildables to fully replace fossil fuel used for electricity generation, it would require massive amounts of new steel (since most steel remains in use for a long time), which requires a Carbon atom from somewhere, usually coal. Plus of course tremendous heat.

Same with silicon, and solar panels are MUCH harder to recycle. Silica to silicon requires not just high heat, multiple times at various steps in the process, but also a Carbon atom, usually supplied by wood and coal.

And of course the machines that mine the materials that go into wind turbines, solar panels, grid lines, substations; the machines to build these things, install them, and maintain them; the factories; the tailings dams; the biodiversity loss and carbon loss from overburden destruction, etc. rarely get acknowledged much less factored into the impacts of these industrial technologies.

Batteries are a toxic destructive nightmare from start to finish.

I like your "banoffees" but I think "bright greens" is the best descriptor I've seen so far (from the book Bright Green Lies). No matter what we call them, the bright green utopia promised by these people is just a fantasy.

And as Bill Rees (Ecological Overshoot guy) says: "The only thing worse than the failure of the energy transition would be the success of the energy transition ... Business as usual is destroying the planet. Business as usual by alternative means is still destroying the planet."

Low energy and local are the future. We are unlikely to get there easily as you point out here; the geopolitical impediments are just too great, as is human addiction to high-energy lifestyles. I'd prefer the entirety of humanity to recognize the value in nature and the right of non-humans and ecosystems to exist for their own sake and not just FOR US, and follow a plan for 2. I am 99.99999% sure that won't happen, and thus we'll get 1. Probably sooner than later.